Global cross-border payment flows are expected to reach USD 156 trillion by the end of 2022, making it one of the fastest growing segments within the global payments ecosystem.

If you sell exclusively online, there is a good chance that you have started international sales (or are in the process of preparing). To grow effectively internationally, you need a good way to manage international payments—transactions that involve the exchange of money across a country or region's border—while avoiding unnecessary cross-border fees and global compliance bottlenecks

The best way to process international payments is locally!

Thanks to technology, accessibility and the Internet, our world has become smaller. We can easily communicate, work and even sell across borders. As a company looks to expand, introducing products and services into new areas is a natural next step.

However, according to a companies survey and how they localize payments for their global customers, only 50% sold in the customers' local currencies, and a full 15% of customers did not do any localization at all! This ignores an increasingly important area of sales and business growth and creates the likelihood of payment abandonment.

This guide takes you through international payments, highlighting the benefits you can expect and the risks to avoid. You'll also learn what features you need in a cross-border payments solution to take full advantage of the continued growth of global e-commerce.

International sales are the future. It is true that domestic e-commerce is growing, but cross-border e-commerce is exploding. Consider these statistics to see how enabling cross-border payments could accelerate your growth.

Small businesses use a variety of services to send and accept international payments. These services differ in terms of their functionality, required resources and costs. Before deciding which option is best for you, consider how payments can be integrated with your existing technology and business systems.

Ecommerce Platforms and Plugins - Ecommerce platforms such as Shopify, WooCommerce, Wix, Prestashop and others dramatically simplify selling online. They offer websites or plugins that integrate business applications and allow you to sell your products. You can manage inventory, marketing, payments and shipping through a single online shopping platform. This simplified approach creates an engaging and personalized online user experience and makes it easy to start selling.

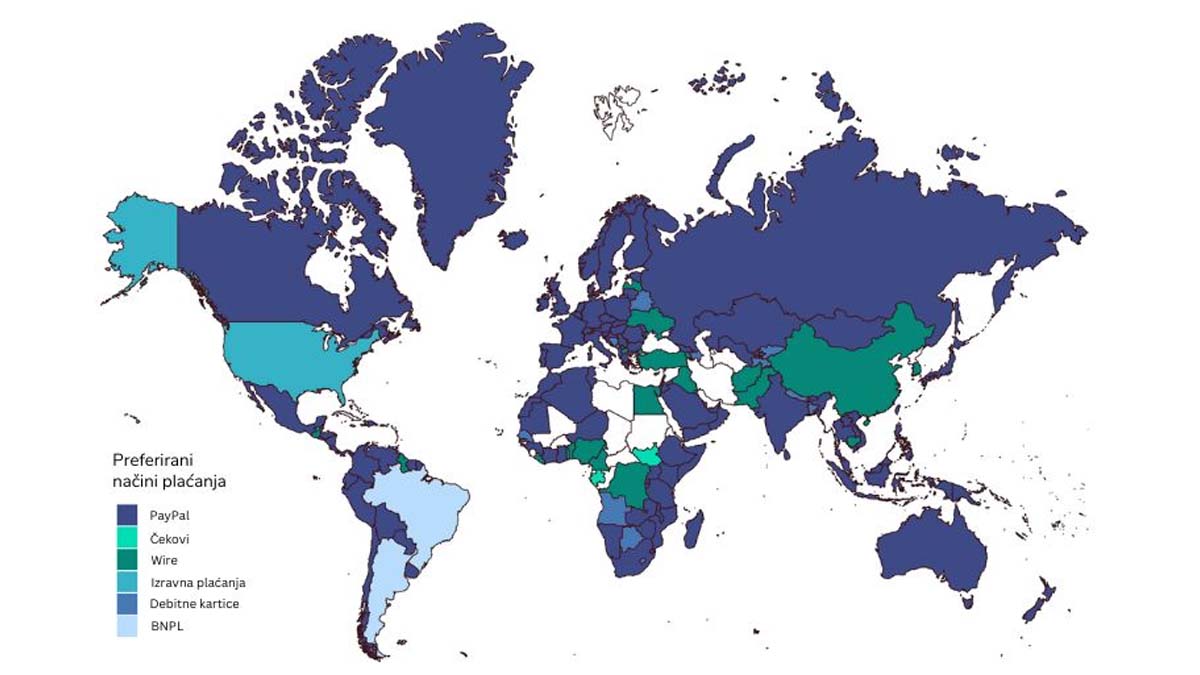

The popularity of payment types varies by region

For example, mobile wallets are the fastest-growing payment methods in Southeast Asia, where the total number of mobile wallets is expected to increase by 311 percent from 2020 to 2025, when the number is expected to reach nearly 440 million by 2025. In North America credit cards are the preferred method of payment and account for 47 percent of all e-commerce transactions.

While cash-based transactions — such as cash on delivery — remain the most popular payment method in Africa, mobile money transfer service M-Pesa has seen significant growth, with a reported 48 million users. Originally launched in Kenya, M-Pesa now operates in Tanzania, South Africa, Afghanistan, Lesotho, Democratic Republic of Congo, Ghana, Mozambique, Egypt and Ethiopia.

Cross-border payments take many forms:

- Electronic funds transfers

- Payment by credit card

- Payment by debit card

- Prepayment by debit card

- Digital currencies

- Digital wallets

- Mobile wallets

- Buy now, pay later (short-term consumer credit)

- Blockchain based payments

Are there challenges associated with cross-border payments?

Despite the advantages they offer, some merchants find cross-border payments intimidating because of their perceived complexity and the fact that the costs associated with them - foreign transaction fees, interchange fees, taxes and so on - can be high. It can also be difficult to predict collection times for cross-border payments and it is challenging to reconcile multiple currencies for revenue accounting. Exchange rates can be confusing for end consumers, which can deter them from buying, and merchants need to ensure they choose the right payment methods for each market.

Certain companies and platforms also have a stronger presence in some regions than others. For proof of this, look no further than Buy Now Pay Later (BNPL): While Klarna is the dominant BNPL provider across Europe and the UK, Afterpay powers the BNPL market in Australia and New Zealand, and Affirm is an important player in North America . When developing a cross-border payment strategy to support global commerce, it is imperative that merchants take these regional preferences into account. Turn international payments into your growth engine.

Today's consumers are more comfortable shopping outside their borders. Cross-border e-commerce is estimated at 22% of e-commerce shipments, a figure that is even higher for certain countries and industries (Statista).

In addition, small businesses have countless opportunities to increase sales and profits abroad. Choosing the right payment partner (PSP) can help bring the market closer together. Offer customers payment methods they recognize and ensure the process adheres to compliance and regulatory requirements.

Growth in digital services and digital commerce will be key to the global economic recovery, but several challenges threaten to disrupt cross-border payments. Different countries have different tax rates, different countries have legal regulations related to sales and data processing (in the EU it is the PSD2 regulation and GDPR), and all this prevents international payment service providers from offering services in some markets. In addition, while new payment technologies have increased competition in the market, different technical and regulatory standards have made it difficult to connect different payment systems and markets.

Cross-border payments are also disproportionately exposed to online fraud and cyber threats, with small businesses particularly vulnerable. Unfortunately, many policies aimed at improving cybersecurity and trust are either ineffective or counterproductive.

What does WSPay enable its merchants to grow their business in external markets?

- 40+ currencies that you can contract for acceptance

- Dynamic currency conversion - DCC allows you to receive the amount that is authorized in kuna, and the customer to be charged in his currency exactly as shown to him at the time of authorization.

- Additional payment methods for external markets - PayPal, Valu, Aircash, Paycek, IPS, KeksPay

- Acceptance of all cards (Amex, JCB, Diners, Discover, Dinacard, Visa, Mastercard)

- Constant WSPay support

Choose a reliable partner in business development.